Flashback to March 6

American History

1933

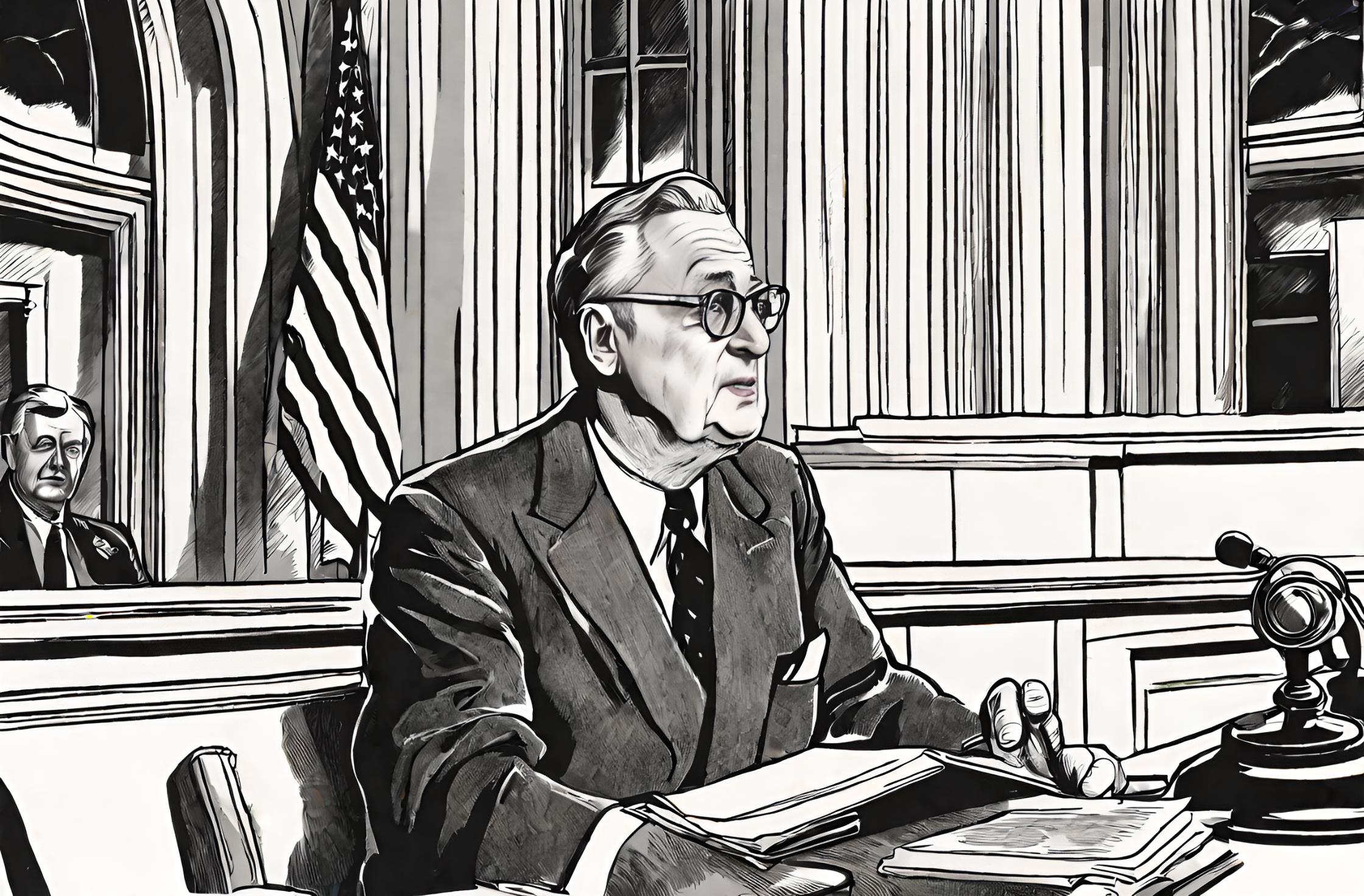

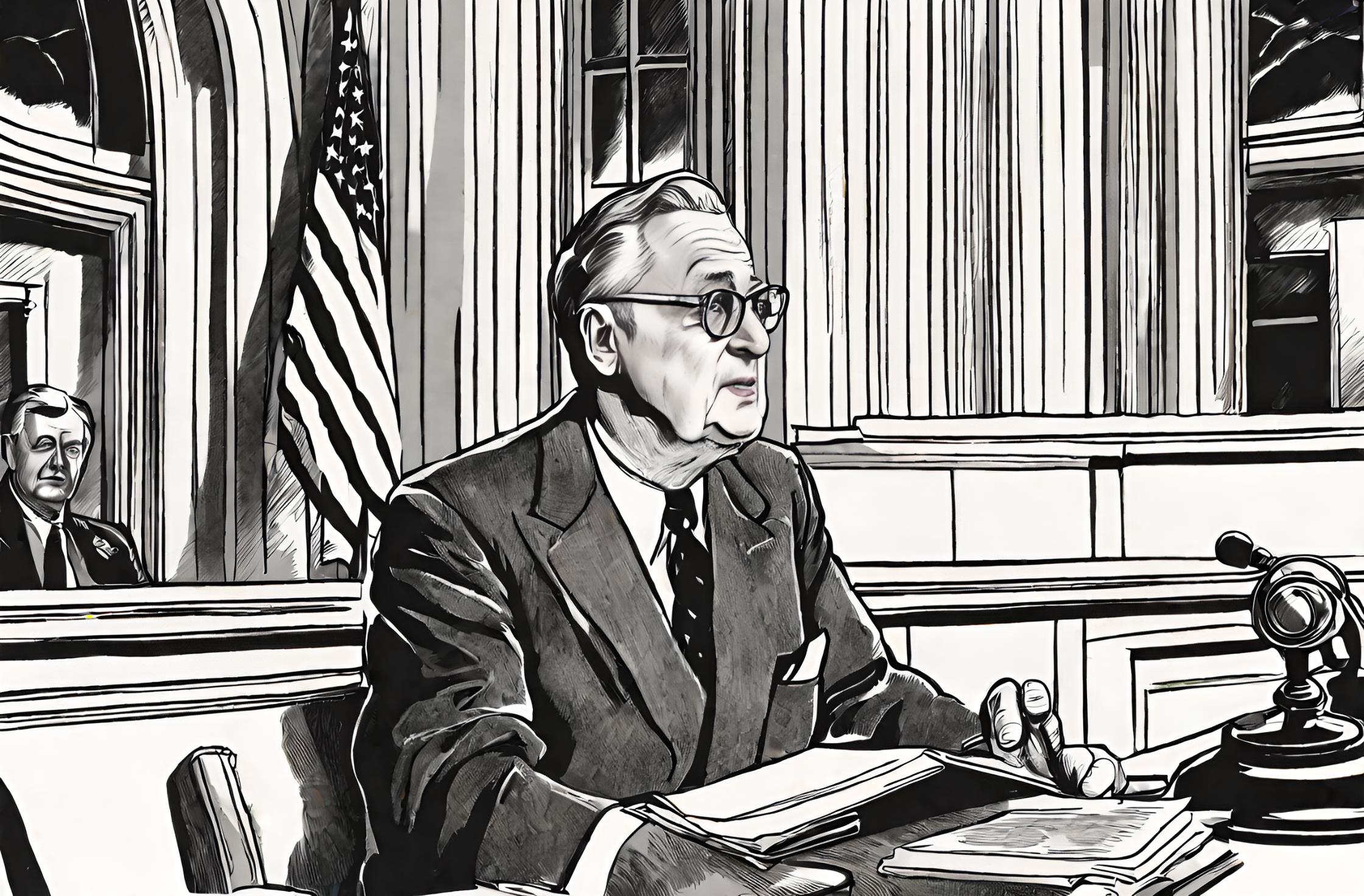

President Franklin D. Roosevelt declares a 10-day “bank holiday,” closing all US banks and freezing all financial transactions

Read moreOn March 6, 1933, President Franklin D. Roosevelt made the unprecedented decision to declare a 10-day “bank holiday,” effectively closing all banks in the United States and freezing all financial transactions. This landmark event played a crucial role in stabilizing the nation’s banking system and restoring public confidence during the Great Depression.

At the time, the United States was in the grip of the worst economic crisis in its history. The stock market had crashed in 1929, leading to a deep and prolonged recession. By 1933, numerous banks were on the verge of collapse, causing widespread panic and a staggering loss of faith in the financial system.

President Roosevelt recognized the urgency of the situation and sought to address it head-on. On March 4, just two days after taking office, he had declared in his inaugural address that “the only thing we have to fear is fear itself.” Two days later, on March 6, he made good on his promise by implementing the 10-day bank holiday.

The primary objective of the bank holiday was to prevent further bank runs. Individuals were rushing to withdraw their savings from banks, fearing that their deposits would be lost if a bank failed. By closing all banks temporarily, Roosevelt aimed to create a sense of stability and prevent the collapse of even more financial institutions.

During the bank holiday, Roosevelt’s administration embarked on an ambitious plan to assess the health and solvency of each bank. Experienced government officials and banking experts conducted detailed examinations of the banks’ assets and liabilities. This process allowed them to identify banks that were sound and those that were in trouble.

Throughout the 10-day period, Roosevelt and his team worked tirelessly to restore public confidence in the banking system. They reassured the American people that their money was safe and that steps were being taken to ensure the stability and long-term viability of the financial sector.

On March 13, 1933, Roosevelt addressed the nation in the first of his legendary “fireside chats.” During this radio broadcast, he explained the government’s actions and outlined the measures that would be taken to reopen the banks. His calm and reassuring demeanor helped to alleviate fears and restore trust in the financial system.

Following the bank holiday, the government implemented a series of measures to strengthen the banks and protect depositors. The Glass-Steagall Act was passed, which separated commercial banking from investment banking and established the Federal Deposit Insurance Corporation (FDIC) to insure bank deposits. These measures aimed to prevent future bank failures and protect individual savers.

The bank holiday and subsequent actions by the Roosevelt administration had a profound and lasting impact on the country’s financial system. They helped restore public confidence, stabilize the banks, and lay the foundation for the economic recovery that followed.

President Franklin D. Roosevelt’s decision to declare a 10-day bank holiday in March 1933 was a crucial step in restoring stability and confidence in the U.S. banking system during the Great Depression. Through careful examination of banks’ health, reassurance of the safety of deposits, and implementation of regulatory measures, Roosevelt’s administration successfully prevented further bank failures. The bank holiday is a testament to the effectiveness of decisive action in times of crisis and remains a landmark event in American history.

We strive for accuracy. If you see something that doesn't look right, click here to contact us!

Sponsored Content

President Franklin D. Roosevelt…

On March 6, 1933,…

The University of Maryland,…

On March 6, 1856,…

Census Bureau forms.

On March 6, 1902,…

Keswick to Penrith railway…

On March 6, 1972,…

117 SD-prisoners executed at…

On March 6, 1945,…